I am calling this the democratisation of forecasting, as the ability to produce a model and a forecast efficiently and cost effectively means it is now available for all businesses.

There have been rapid developments in the use of cloud based technology for the finance function to the extent that there is every reason for any business of any size to have a financial model and a forecast.

The key benefit this brings is foresight, allowing business owners to see the consequences for future cash balances, liabilities and profits of current results. This allows better planning for investment, payments to shareholders, recruitment, innovation, growth and so forth as well as focusing the mind on corrective actions that may need to be taken.

My clients have described it variously as “removing the blindfold”, “showing me the way ahead” and “demonstrating the consequences for the future of the way the business is performing today”. Business is ultimately about winning in the marketplace and a fluid financial model and forecast can contribute greatly to getting and staying ahead of competitors. It is as close as you will get to a crystal ball for your business

finances! The two areas can bring great insights.

The financial model will set a benchmark for the core business activity and focuses on understanding the interactions between sales, costs of sales and gross margin. This is basic stuff but I am surprised by how often it is not well understood and often the underlying book-keeping is not robust enough to support a full and accurate analysis. It is the heart of the business and a clear understanding and target can add much to performance.

It is the rolling forecast that I find is the most beneficial for clients that are using these for the first time. The time for complicated spreadsheets and days to prepare are gone. Once the original budget is in place, updating is very efficient using the right technology. The combination of actual results to date plus budget figures to year end, or longer, instantly shows the impact of either exceeding or missing the budget. Nowhere is this more powerful than in the rolling cashflow forecast. Removing much of the uncertainty around future cash balances and giving the time to act is a guarantee to more undisturbed nights.

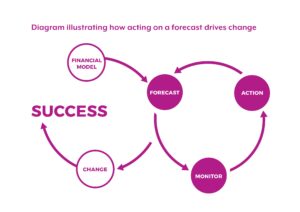

These tools, along with monthly video catch ups to review performance, are rapidly becoming the norm in the way we work with business clients. Understanding the results today, the impact for tomorrow and proactively changing those potential outcomes is fundamental to success and will be a game changer for all sizes of business. Therefore we foresee the democratisation of financial forecasting, as technology allows effective monitoring of your business for the many rather than the few.

Read our case study about how forecasting has helped one of Will’s clients: The power of real-time financial information is a game changer for truhouse.

Contact Will Abbott for more information by emailing will.abbott@randall-payne.co.uk or call 01242 776000.