Having worked with businesses preparing for sale, we have seen how financial stability shapes both buyer interest and valuation. Hari breaks down what serious buyers look for before making an offer.

Corporate Finance

When it comes to selling your business – a milestone you’ve poured years of effort into – getting the right guidance can be the difference between simply closing a deal and truly maximising value explains Ollie.

Are you aware of the current market value of your business? With recent changes to Inheritance Tax, proactive planning is now more crucial than ever for businesses at or above a valuation of £1 million.

A well planned and orderly sale process allowed bespoke’s shareholders to exit the business in just five months.

How does an Olympian achieve a gold medal winning, world record breaking performance and what does this all mean in the world of business?

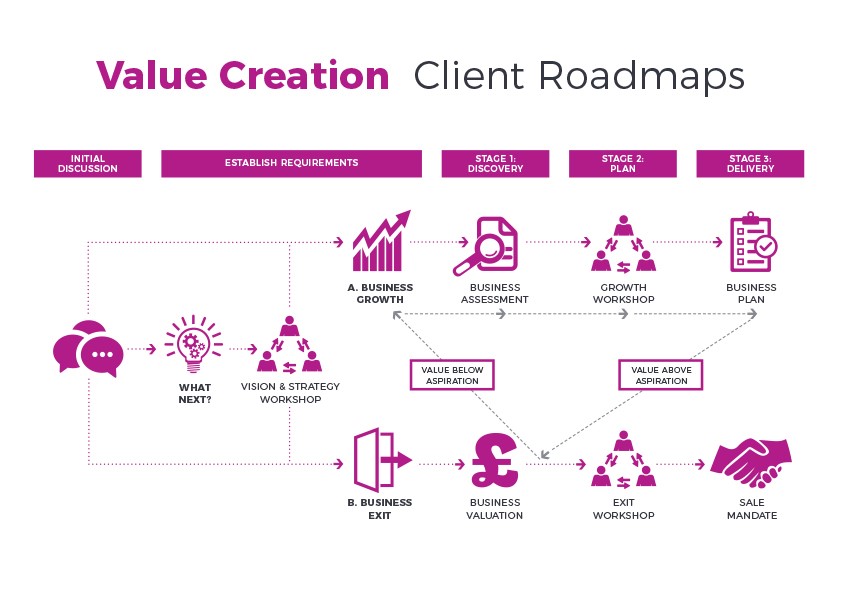

Ollie explains the process we adopt in delivering the right outcome for clients using our Client Roadmap.

Bringing the business to life with a comprehensive Information Memorandum secured sale success for MG Scaffolding. Ollie explains how the desired outcome was achieved.

Recently, we have been helping a number of our entrepreneur clients develop exit strategies. Ollie outlines the many issues to consider in doing so.

James outlines the four HMRC ‘tax-advantaged’ schemes that provide employees and employers with income tax and National Insurance Contribution (NIC) advantages

Ollie explains a successful exit typically represents the culmination of moving through a business lifecycle and what it is focused on.

Following UKIFDA, Ollie and Will outline the different options for succession planning targeting the oil sector in conjunction with Fuel Oil News magazine.

Ollie explains about our knowledge and experience in the fuels sector which is the reason for exhibiting at UKIFDA.

Ollie explains the purpose of the shareholders’ agreement and the key areas to be considered.

Rob explains why now could be a good time to think about selling your business and the different options available to you and your business.

Will talks about the democratisation of forecasting, as the ability to produce a model and a forecast efficiently and cost effectively means it is now available for all businesses.

Having acted on a significant number of acquisitions and sales of businesses over the years Ollie understands the TUPE requirements and now he’s been involved in the process ‘first-hand’.

James explains some of the key issues around share ownership for family businesses and the current stance of both HMRC and the tribunals in terms of what is most effective and acceptable practice.

This success story shows how an unforeseen acquisition can become a gateway to new markets

Support for businesses through this period of financial uncertainty and how we can help you with finance or financial forecasts

Ollie Newbold shares his knowledge on how a business can be effectively marketed for sale